Eurostar – best known for connecting London with Paris and Brussels via high-speed trains – is international by design.

Its core customer base is concentrated in the five countries in which it operates, but passengers from further afield are increasingly important. Last year, one in every eight customers was from outside Europe, and this number is expected to grow further in 2025.

Speaking exclusively to Skift for the latest in our Leaders of Travel: C-Suite Series, Eurostar chief executive, Gwendoline Cazenave, shares her candid insights on U.S. booking trends, premium travel, and why she believes “punitive sustainability” doesn’t work.

What Is Eurostar?

As a French native and 20-year veteran of the rail industry, Cazenave is aware of the traditional perception of the company. “Eurostar is actually much more than a train underwater from London to Paris,” she quips. A 2022 merger with continental high-speed operator Thalys expanded Eurostar’s footprint. “It’s now 28 destinations in Europe, across five countries.”

Cazenave uses the term “high flows” to describe what Eurostar does. It’s a compelling combination of high-speed, high-frequency, and high-capacity travel. At peak times between the company’s biggest cities – London, Paris, Brussels, Amsterdam, and Cologne – there’s a train every 30 minutes. On key routes, Eurostar’s trains have 894 seats. That’s the equivalent of five Airbus A320 aircraft spread across 16 carriages.

The company serves a catchment area of 245 million customers, but this isn’t a closed-loop operation for locals. Overseas consumers are a vital part of Eurostar’s business model, especially when filling more lucrative premium seats.

Outside of Eurostar’s home markets, North America is the star performer, with transatlantic travelers helping make last year the company’s most successful yet. Around 19.6 million passengers used the network in 2024, a rise of 850,000 year-on-year. Today, North America trails only the U.K., France, Belgium, and the Netherlands in terms of total passenger revenue.

Why America Matters

Sharing exclusive data with Skift, Cazenave reveals that Eurostar receives an average of 360,000 searches from the United States every month. When booking rail travel in Europe, one in every two American customers connects with the Eurostar website, with around 70% of sales via direct distribution channels.

Around 60% of searches are for the flagship Paris to London corridor, but other city pairs are rising in popularity. Among U.S. travelers, interest in services from Paris to the Netherlands is up 30% year-on-year, while Paris to Brussels is up 50%.

In recent quarters, the company has enjoyed double-digit growth in the number of U.S. passengers across its network, but could the good times be coming to an end?

The American travel industry is on recession watch, with several major airlines downgrading forecasts since the start of March and fears of a broader slowdown. Eurostar is not immune, with 23% of its corporate clients being U.S.-headquartered companies.

Asked if Eurostar is seeing any softness in bookings from U.S. outbound travelers, Cazenave delivers an upbeat assessment: “Not at all. The whole market is booming and even more from the American market. The U.S. is absolutely booming.”

Alongside transatlantic traffic, she highlights India as a particularly strong emerging market, joining more established players in Southeast Asia and China.

Forward sales data supports the chief executive’s commentary. Eurostar bookings among U.S. consumers are up 23% year-on-year for April, with the peak summer period offering even greater growth. U.S. demand in June and July 2025 is currently tracking up 45% compared to the same time last year.

Cazenave notes that the vast majority of U.S. travelers on Eurostar travel for leisure. Around 80% are on vacation, with a further 10% visiting family and friends. While only 10% are on business trips, she confirms that no matter what the reason for travel, American passengers enjoy trading up. This includes the company’s signature Premier class, which up to a third of U.S.-based passengers select.

Cazenave highlights the relatively modest price difference between standard and Premier fares as being a key driver for U.S. visitors. For some off-peak trips, this can be as little as $150. “The American market is not used to that. You upgrade to a [long-haul] business class flight and it is $3,000, $5,000, it’s so much more. They really want that experience – and they love our cocktail bar.”

Sustainability on the Decline?

Economic volatility isn’t the only unsavory item on the menu du jour. Recent policy shifts in Washington have sparked a lively debate about the relevance of corporate environmental, social, and governance (ESG) initiatives.

With environmental sustainability a key selling point for Eurostar, is Cazenave concerned that businesses and possibly even regular consumers will revert to air travel?

“Eurostar has never pushed for punitive sustainability. It’s very much about making their life good for the planet, but also good for them,” she says.

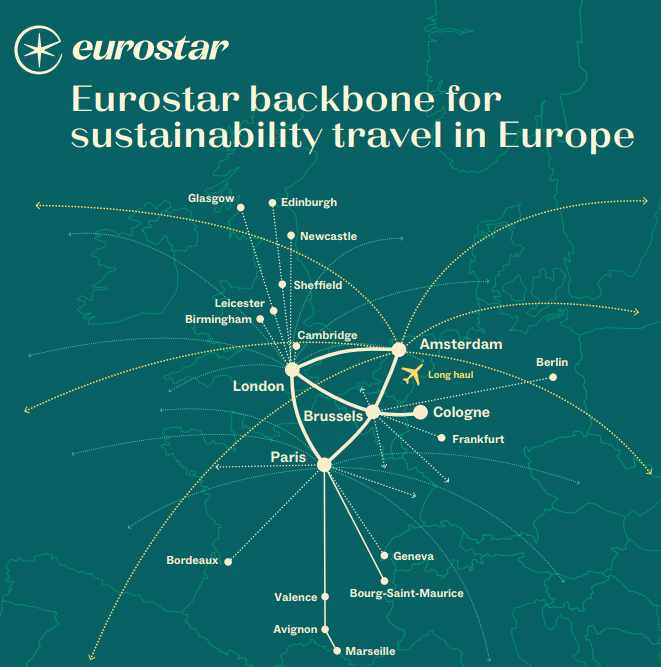

During our conversation, Cazenave proudly presents “Eurostar’s backbone for sustainable travel in Europe.” It’s a network map displaying not only the company’s hub cities but also feeder and onward travel options. Significantly, these include air travel and connections through Amsterdam’s Schiphol airport which Eurostar serves directly.

Last year, Eurostar signed a memorandum of understanding with the SkyTeam alliance, in a step towards becoming the organization’s first non-airline transport provider. The company will happily snatch market share from airlines flying from London to Brussels, but it acknowledges that rail isn’t practical for every journey.

“Eurostar means traveling from city center to city center. It’s a train every 30 minutes. It’s the exclusive lounge when you travel in Premier,” Cazenave says. “The Eurostar agenda is of course for customers wanting to travel sustainably, but also traveling with us because we are comfortable, convenient, and because our fares are flexible. There’s room for your legs. Your children under four can travel free. It’s about positive sustainability and a customer-tailored experience. That’s who we are and that’s what we’re pushing.”

Eurostar’s Distinctive Approach

For consumers institutionalized by the airline industry’s hyper-strict policies on everything from luggage to liquids, Eurostar’s more relaxed approach can come as a welcome surprise. But is the company leaving money on the table?

Ancillaries such as assigned seating and paid baggage are a huge source of additional revenue for airlines. At some budget carriers, these ‘add-ons’ make up as much as 30% of operating margin. Asked why Eurostar doesn’t adopt more of these proven profit-building strategies, Cazenave acknowledges that it is a “very, very interesting question.” However, it ultimately comes down to market and brand proposition.

“Eurostar is something that is seamless. You book, and then if you change your mind, you can rebook; it needs to be simple. That’s the unique travel experience we are pushing and the way we can push for growth. It’s a sustainable experience with a positive vision for growth and for the planet. I want it to be easy. Eurostar is something that needs to be easy. The easier it will be, the more growth we’ll have, the more sustainable travel we’ll be able to have.”

Does Eurostar Have it Too Easy?

Opinions on Eurostar vary depending on who you speak to. Its supporters hail the company as a progressive champion that proves the train can be real competition for the plane. Others highlight its monopoly on key intercity routes, particularly for walk-up passenger services linking the United Kingdom and the continent.

Since its inception more than three decades ago, Eurostar has faced the threat of competition from rival rail operators. Despite plenty of false starts, none have materialized so far.

Key railway stations such as St Pancras in London are approaching capacity, but there is plenty of room to run additional services through the Channel Tunnel itself, which is owned and operated independently of Eurostar. The bottleneck is not at 246 feet below sea level (that’s the equivalent of 107 French baguettes balanced on top of each other) but at busy terminus stations in European capitals.

The competitive landscape could change significantly in the coming years. Feasibility studies are in the advanced stages and financial backers are currently being sought for multiple competing companies. This includes industry heavyweights such as the Virgin Group which has expressed interest in launching its own international rail services from London.

Asked about the prospect of credible rail-based competition to its network, Cazenave initially takes a pragmatic view: “Our perspective is that the development of sustainable travel is good. It’s good for the planet, good for society, it’s good for customers.”

Then, putting platitudes to one side, Cazenave quickly shifts gear: “International sustainable travel is a race, and we are accelerating. We have an objective [to carry] 30 million passengers. We are investing in 50 new trains; it’s a €2 billion [$2.16bn] investment. My call to action for European mobility stakeholders is about growth, it’s about investment, it’s about capacity.”

Read more from our Leaders of Travel: Skift C-Suite Series here.

Airlines Sector Stock Index Performance Year-to-Date

What am I looking at? The performance of airline sector stocks within the ST200. The index includes companies publicly traded across global markets including network carriers, low-cost carriers, and other related companies.

The Skift Travel 200 (ST200) combines the financial performance of nearly 200 travel companies worth more than a trillion dollars into a single number. See more airlines sector financial performance.

Read the full methodology behind the Skift Travel 200.