Hospitality tech company Lighthouse announced Thursday that it had raised $370 million in series C funding, the latest sign of investor demand in this fast-growing space.

It’s one of the largest fundraises ever for a hospitality tech company. It’s been a big year for funding in that sector, with Flyr having raised a total package of $300 million in August.

London-based Lighthouse (formerly OTA Insight) helps hotels and short-term rentals analyze their market demand, rates, and positioning. The company last raised $80 million in 2021.

Venture Capital in Travel

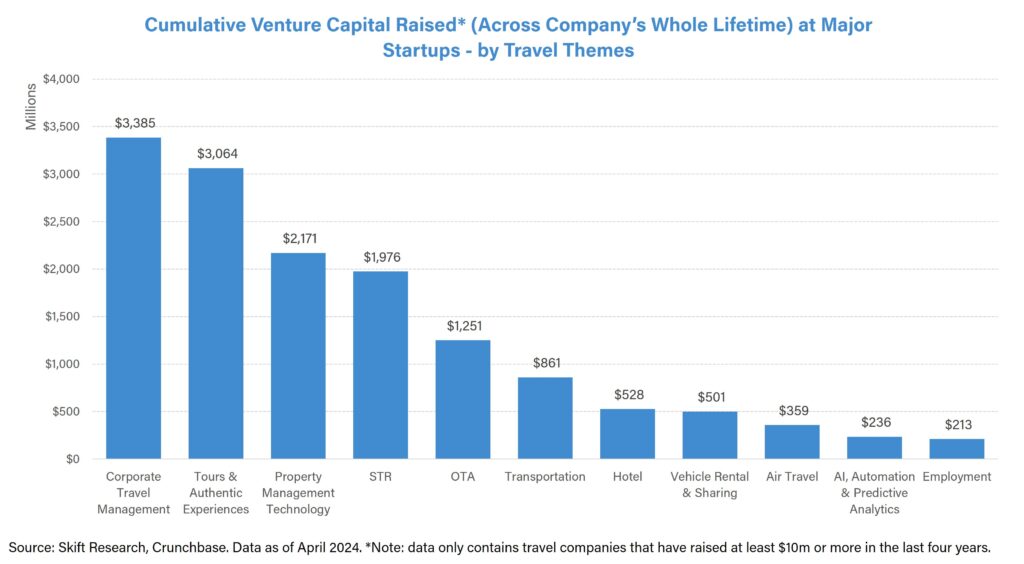

As we wrote in a recent Skift Research report, Venture Investment Trends in Travel 2024, we are increasingly seeing more investment into companies that focus on making processes more efficient – particularly through tech innovation.

Venture capital funding into companies focussed on AI, automation & predictive analytics is a key area of investor interest. Our data showed a 30% annual increase in venture capital funding into travel companies focused on AI in 2023.

At Skift’s 2024 Data & AI Summit, Chris Hemmeter, managing director of Thayer Ventures, highlighted that there remains a large opportunity for technological advancement in the travel industry – a gap that could be potentially filled by AI:

“We really feel that there is a decoupling between the tech platform that drives the world of accommodations, principally hospitality, and the traveler,” he said. “That decoupling has reached a critical point which is now driving the classic flipping of the iceberg which makes it one of the best times to be an entrepreneur and an investor in the category”.

More and more investment is being directed towards companies that focus on using data more efficiently, particularly through technological advancements. In the chart below, we present the top companies that have raised the most venture capital funding across their lifetime.

Two of the top three themes are led by companies focused on hospitality tech: corporate travel & expense management companies, such as Navan and Travelperk, and property management technology companies, such as Guesty and Mews.

A recent survey by Amadeus shows an increased appetite for technology investment by senior decision makers at travel businesses. The survey showed that:

- 94% of decision makers in the hospitality industry are planning investment in technology next year as part of their business strategy.

- Hoteliers are planning an average 16% increase in investment in technology in the next year.

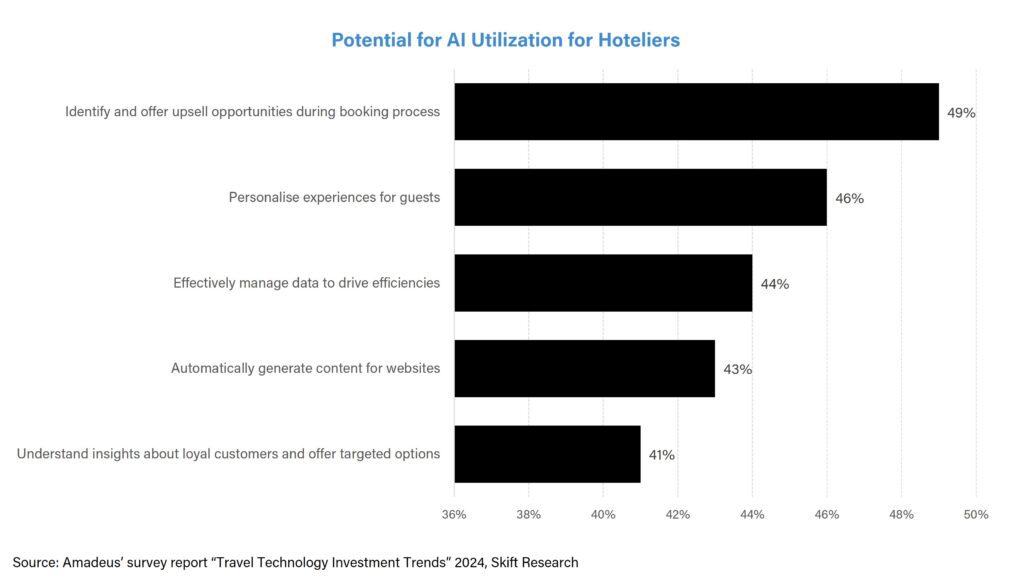

- Nearly all hoteliers (98%) “recognized that AI has the potential to bring significant benefits to their businesses.”

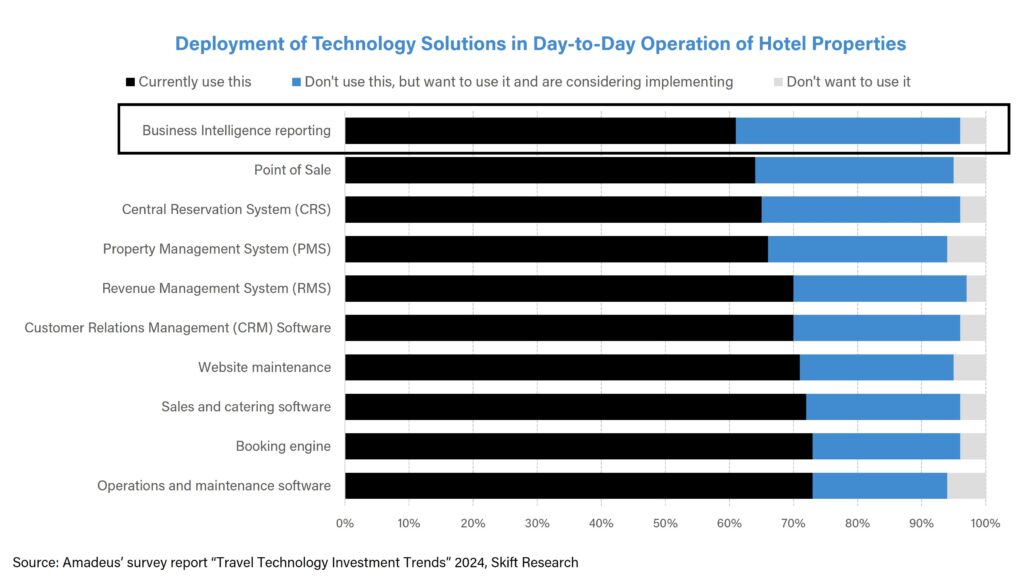

Many hoteliers (70%+) currently use operational tools such as operations and maintenance software, but a relatively smaller percentage of hoteliers (around 60%) are using business intelligence reporting to drive the day-to-day operations of their properties.

Business intelligence will be a key area of investment for hoteliers in the coming years, with Amadeus’ survey showing that 35% of hoteliers want to implement it more concretely into their business strategy.

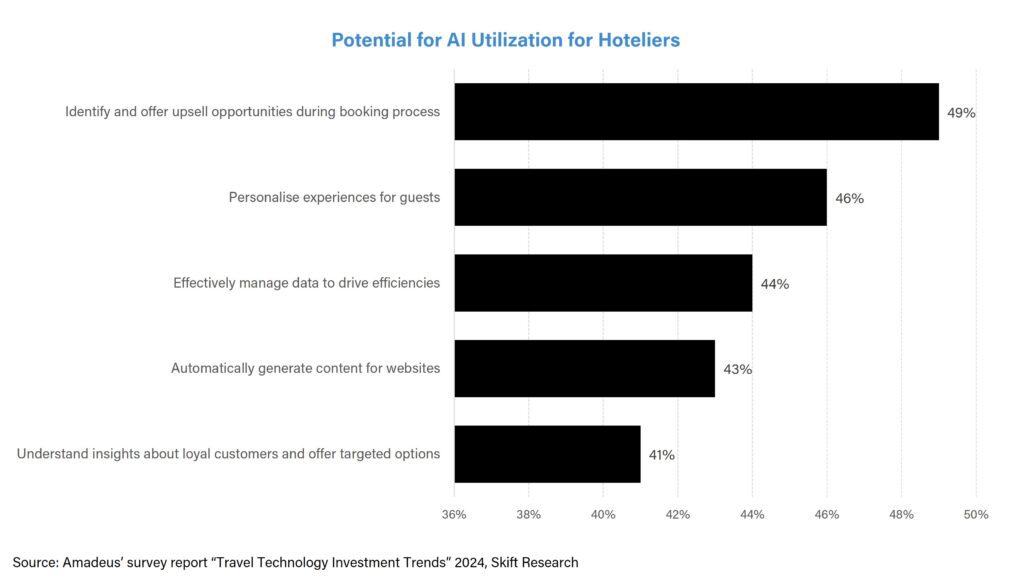

The leveraging of data and analytics is fundamental in effectively implementing AI tools to drive actionable insights. The potential for AI utilization in hospitality is vast (read our deep dive into AI in travel: Generative AI’s Impact on Travel), with opportunities to better upsell products, offer a more personalized experience to guests, and effectively manage data to drive operational efficiencies.

Additional Reporting by Justin Dawes